LegalShield February Economic Stress Index Foreshadows Potential Surge in Evictions and Foreclosures Despite Newly Promised Stimulus

Released today, The LegalShield Foreclosure Index jumped in February to its highest level since July, as LegalShield plan members sought to manage financial challenges by contacting their law firm for advice and consultation during the country’s massive pandemic lockdown. While evictions and foreclosures are still well below pre-pandemic levels, millions of homeowners have fallen behind at least three months on their mortgage. Many of these borrowers will have been in forbearance for over a year. LegalShield forecasts a rise in usage of legal consultations on related topics.

“The use of legal services has consistently proved to be a leading indicator for subsequent economic and financial activity. Unfortunately, as our members use our service for advice on foreclosures, evictions, and landlord/tenant issues, we believe we will see a rise in these events. The large number of delinquent mortgages and borrowers in forbearance further supports that there is trouble on the horizon,” said Jeff Bell, LegalShield CEO. “People are fearful of facing enormous past due bills when federal eviction and foreclosure moratoria end. But, at some point, this debt must be addressed. Even if those who are currently in debt suddenly find jobs and can start paying off their debts, borrowers are unlikely to be able to make a lump-sum payment to cover any missed months.”

The LegalShield Economic Stress Index™ is constructed from the company’s proprietary data reflecting demand for legal services and provides actionable intelligence about the near-term direction of the U.S. economy. It is both highly correlated with and predictive of the foremost economic indices around consumer confidence, housing starts, bankruptcies, existing home sales, and foreclosures.

Highlights from the February 2021 LegalShield Economic Stress Index™ are as follows:

- The Consumer Stress Index edged up in February as more LegalShield plan members sought assistance in dealing with consumer / finance issues including billing disputes, credit repair, insurance matters, etc. This Index increased (worsened) 1.3 points in February to 64.1—meanwhile, the Conference Board’s Consumer Confidence Index increased 2.4 points to 91.3 in February. The LegalShield Consumer Stress Index suggests that stress should remain low over the next one to three months, especially with another round of forthcoming stimulus and relief paired with a steady increase in vaccinations.

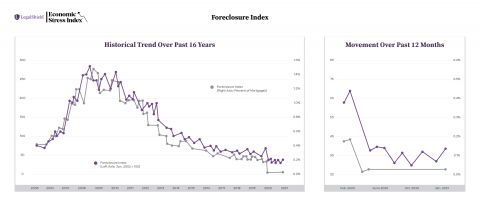

- The Foreclosure Index increased (worsened) 5.5 points to 38.1 in February, though it is 42% below year-ago levels. The index continues to closely track foreclosure starts, which remain at an all-time low as of Q4 despite a sharp rise in delinquencies during the pandemic. Foreclosures are expected to remain low while the federal eviction and foreclosure moratoria remain in place. However, recent movement in the LegalShield Foreclosure Index is worth monitoring in the weeks ahead and suggests that foreclosures may rise later this year once moratoria are lifted.

- The Housing Sales Index fell 2.4 points in February to 112.8 but remains historically elevated as plan members continue to seek legal assistance with homes sales, home purchases, refinancing, etc. Meanwhile, existing home sales were mostly unchanged, inching up 0.6% in January. Existing home sales were 24% above their year-ago level. Demand for existing homes remains remarkably strong despite surging prices. This strong demand, coupled with supply-side constraints, has led to plunging inventory of existing homes (now at an all-time low of 1.04 million units). Though these headwinds may weigh on home sales later in the year, the same factors that fueled a surge in housing sales last year should continue to support continued sales growth in the near term

- The Housing Construction Index fell from 138.3 to 131.7 in February, marking the lowest level since July. The housing industry continues to lead the economic recovery, as the pandemic and low interest rates motivate consumers to buy and build single-family homes. LegalShield continues to see a high rate of plan members seeking assistance with construction contacts, zoning permits, and interpretation around oil, gas, and mineral rights. Although rising costs are a headwind to housing construction, the LegalShield Housing Construction Index, among other economic indicators, suggests homebuilding activity will stay healthy over the next three to six months.

- The Bankruptcy Index was little changed in February and remains near its all-time low. While federal relief is currently keeping consumers afloat, signs of financial stress are simmering. In addition to taking advantage of rent moratoria, an increasing share of consumers relied on “buy now pay later” (BNPL) programs for their holiday purchases. Research suggests that up to 50% of BNPL users are using BNPL because they already maxed out existing lines of credit or had a credit rating so poor that they were disqualified from traditional credit cards.

Keybridge LLC, a boutique economic and public policy consulting firm based in Washington D.C., is responsible for independently compiling and analyzing the LegalShield data and developing the accompanying economic narrative.

About LegalShield and IDShield

A trailblazer in the democratization of affordable access to legal protection, LegalShield is the world’s largest platform for legal, identity, and reputation management services covering more than 4.4 million people. Its IDShield identity theft solution for individuals and families has more than one million members. LegalShield and IDShield serve more than 140,000 businesses. In addition, over 34,000 companies offer LegalShield and IDShield plans to their employees as voluntary benefits. Both legal and identity theft plans start for less than $25 per month. For more information about LegalShield, visit: https://www.legalshield.com or for more information about IDShield, visit: https://www.idshield.com/.

Contacts

Jennifer Gaglione

PH: 216-870-6333

Email: jennifergaglione@legalshieldcorp.com